The Clark Kerr Lecture Series

The Political Economy of Cost Control on a University Campus by Lawrence S. Bacow and Towards Sustainable Financing of Higher Education by Richard C. Levin

Foreword

Kevin Guthrie and Catharine Bond Hill

November 20, 2024

The 2017 Clark Kerr Lectures at the University of California, Berkeley, were delivered by two distinguished economists—Lawrence Bacow and Richard C. Levin. In addition to conducting research on the economics of higher education during their academic careers, these economists have served as presidents of colleges and universities (Tufts and Harvard Universities and Yale University respectively). They have therefore not just researched the issues facing higher education; they have experienced firsthand the major challenges facing their institutions and higher education more generally. While current events suggest issues around free speech, student activism, and diversity, equity and inclusion policies are among the major challenges facing colleges and universities in 2024, these lectures focus on a longer running challenge, the desperate need to bend the cost curve. The public’s concerns about the cost of higher education and its resulting inaccessibility to many families have contributed to the eroding trust among the public, making it a target in an extremely polarized political environment. Policymakers on both sides of the aisle are responding to the concerns of their constituencies, and higher education is at grave risk of losing public support, and the financial resources that go along with that, if institutions do not take concrete steps to address this loss of public trust. Controlling costs and making a quality degree more affordable for more families would go a long way toward doing so.

The public’s concerns about the cost of higher education and its resulting inaccessibility to many families have contributed to the eroding trust among the public, making it a target in an extremely polarized political environment.

These economists identify the underlying reasons that there have been relentlessly rising costs. First, as an industry, higher education suffers from the Baumol-Bowen cost disease. Because higher education requires skilled labor (faculty and staff), if there are no productivity increases (changes in the ratio of skilled employees per student), costs will go up when skilled labor’s wages in the market go up. Other factors also play a role. Colleges and universities compete for students, so generally need to spend more to make their programs more attractive. In this environment, competition increases costs rather than controlling them. While cooperation to hold costs down could help, it is discouraged by the Department of Justice because such cooperation could also be seen as an effort to keep tuition up and financial aid down.

In their lectures, these economists and former presidents also clearly articulate the risks of not addressing the problem. All sectors of higher education benefit from federal and state support. Publics receive state appropriations to support operations (even if constrained in recent decades). Publics and privates both benefit from federal research support, financial aid grants and student loans, and special tax treatment including tax free earnings on endowments and incentives for charitable contributions on the part of alumni and others. The endowments of the wealthiest schools are already being taxed, demonstrating that the financial support on the part of the government is not as untouchable as it was once thought to be.

Finally, both suggest paths forward. Technology can play a role, although finding a way to share any efficiency gains from technology with faculty will be important to gaining their support. If deploying new technology is just a means to replace faculty, then resistance and shared governance will make change difficult. Technology can help by reducing costs of existing services, such as advising, tutoring, or language instruction. In addition, it can generate new revenue streams by offering courses online to new learners who would not otherwise be attending in person, significantly increasing the student/faculty ratio at colleges and universities.

Greater cooperation across institutions is also needed. Sharing scientific equipment and facilities, library resources, purchasing, and other back-office services are the low hanging fruit. Curriculum cooperation will be more difficult but is an area of opportunity for reducing duplication and benefiting financially from economies of scale. Creating the right incentives on the real costs of adding physical space can also avoid unexpected expenses in the future which contribute to rising costs. Finally, some of the increase in costs that are passed on to students and their families could be reduced if states and the federal government allocated more resources to higher education. But the demands of entitlements and the rising costs of healthcare make this unlikely.

Absent progress, higher education risks further losing the public’s trust which will contribute to undermining America’s competitiveness in the 21st century.

Bacow and Levin clearly articulate the reasons for the increasing costs of higher education and the risks that this presents in terms of public support. They also make clear that there is no easy way to bend the cost curve, but that technology does offer opportunities to improve productivity and should be implemented carefully. A variety of interventions are needed and will require collaboration among federal and state policy makers, higher education leaders, as well as faculty. Doing that hard work is so important to the future of higher education in America. Absent progress, higher education risks further losing the public’s trust which will contribute to undermining America’s competitiveness in the 21st century.

The Political Economy of Cost Control on a University Campus

Lawrence S. Bacow

April 20, 2017

Introduction

Few issues in higher education have commanded more attention in recent years than escalating costs. Indeed, it is hard to pick up a newspaper these days without reading about yet another increase in tuition (typically in excess of the rate of inflation) or an opinion piece railing against college administrators for their inability or their unwillingness to stem the tide of rampant cost increases.

I have a confession to make. I am one of those administrators. From 1998 until 2001, I was chancellor of MIT, one of the Institute’s two most senior academic officers. From 2001 until 2011 I was president of Tufts. And since 2011 I have served as a member of the Harvard Corporation including chair of the University Finance Committee. In each of these positions, I barely laid a glove on rising costs, and it was not for lack of trying. In this lecture, I would like to reflect upon why cost control is so difficult.[1]

I would like to make four arguments.

- First, that the greatest challenge facing higher education is bending the cost curve.

- Second, that doing so is incredibly hard for a variety of reasons not the least of which is that there is no natural constituency for cost control on most university campuses. This is the essence of my argument.

- Third, in those instances where college costs have been successfully moderated it is almost always due to exogenous constraints on revenue that have forced institutions to cut back.

- And finally, if we wish to see progress on cost control we need more cooperation among colleges and universities, or to put it more sharply, we need to limit competition among higher education institutions that tends to drive costs inexorably higher.

The biggest challenge facing higher education

I used to believe that access posed the most significant challenge to higher education. By access I mean the need to ensure that talented students could obtain a first-rate education regardless of their ability to pay. Traditionally, higher education has served as the primary means for achieving social mobility in this country. College functioned as an escalator onto which talented but poor students would enter, and in one generation, they would often be projected into the upper socio-economic ranks of society. To put it another way, college enabled the American Dream which is why higher education has traditionally enjoyed widespread political support.

Unfortunately, access remains a challenge. Not only is it still hard for many talented but poor students to get the education they need to succeed, recent research by David Autor, Raj Chetty and others suggests that higher education may actually be contributing to income inequality.[2] Stated simply, in an economy that increasingly values higher level skills, the disparity between lifetime earnings of high school and college graduates is growing. Because college graduates are disproportionately drawn from the ranks of higher income families, higher education is amplifying income inequality.

So if access remains problematic, why do I believe that bending the cost curve is the biggest challenge facing higher education?

If we fail to curb college costs, we will not only price many students and their families out of the market, we risk all of public support for higher education. And lacking that support, we will never make progress on access. We may also jeopardize the financial foundation on which our colleges and universities rest.

If we fail to curb college costs, we will not only price many students and their families out of the market, we risk all of public support for higher education.

Some data: In 2001, the average tuition, fees, room and board for an in-state student at a public four-year college or university represented 21 percent of median family income. By 2015, that number had climbed to 35 percent.[3] Now admittedly these numbers focus on sticker price. But it is sticker price that gets the attention of legislators, op ed writers, and increasingly the electorate. It is also true that during this same period we have seen a shift away from need-based aid to merit aid. Put another way, financial aid to the middle and upper middle classes is growing at a faster rate than financial aid for the poor.[4]

Higher education costs are rising at a rate even faster than health care costs and have been for some time.[5]

This situation cannot go on forever, and things that cannot go on forever eventually come to an end.

To be sure, much of the increase in tuition and fees over the past 15 years represents the withdrawal of state support and the shifting of costs from the taxpayer to students and their families, but that is my point. Public anger over rising college costs makes higher education an easy political target especially in tough times.

Note that even the wealthiest public and private institutions are enormously dependent on public support that goes beyond state appropriations. For example, every research university is dependent on the federal government for research support, indirect cost recovery, Pell Grants, and federally guaranteed student loans. Colleges and universities are also tremendously exposed to changes in tax policy that would limit the charitable deduction, potentially subject university endowments to taxation, or would challenge the tax-exempt status of college and university real estate holdings.

My point is that we continue to let college costs rise at our peril. Every institution has an interest in trying to bend the cost curve. This is especially true of the most elite institutions that receive a disproportionate share of federal research support and media attention.

So why is cost control so difficult?

In their classic study on the performing arts, William Baumol and William Bowen observed that in any industry in which productivity growth lags that of the economy as a whole costs will rise faster than inflation.[6] Absent productivity gains to offset rising labor costs, overall costs inevitably will rise.

Higher education is a classic example of just such an industry. The production function for a college education has changed little in the last few hundred years. To a first approximation, we are still educating students the same way we were hundreds of years ago with chalk and talk or what has sometimes been described as the sage on the stage. In fact, this event is a good illustration of the durability of the lecture format. Ask yourself, “Why did many of you travel some distance to attend in person when you could have viewed my talk online?” As attendance at sporting events, rock concerts, and even symphony orchestras suggest, participating in an event in person is still quite different than participating digitally.[7]

Now there is some hope that online learning will radically transform the educational production function, but the jury is still out. While I believe that online education will only get better over time, I am skeptical that it will bring about the massive transformation and cost savings that some of its proponents advocate.[8]

Beyond Baumol-Bowen Cost Disease, I would like to argue that it is difficult to control costs in a university setting precisely because there is no natural constituency for cost control on a university campus.

… it is difficult to control costs in a university setting precisely because there is no natural constituency for cost control on a university campus.

But before I get to the crux of my argument, I would like to tell a story. Shortly after I was named president of Tufts, Paul Gray, the former president of MIT, pulled me aside to tell me what my new life would be like. He said running a research university was like trying to navigate an 18-wheel truck down an icy, hilly, mountain road with multiple switchbacks, no guard rails, and thousand-foot drop-offs. If that were not hard enough, he said, faculty had their hands on the wheel, students had their feet on the accelerator, and alumni and the board had their feet on the brake. He then pointed at me and said, “Of course you are responsible for the outcome!”

While this story always gets a chuckle, I think it illustrates the core of the problem.

Every university president needs to pay attention to three major constituencies: faculty, students and the board. To be sure, there are others who matter including alumni for which the board is a proxy, staff, neighbors and government officials but faculty, students and the board are always front of mind.

As a university leader, to bring about any kind of meaningful change requires that you agitate at least one of these groups. A leader with goodwill in the bank can afford to have one of these groups upset with them at any point in time but rarely more than one simultaneously.

As we explore the interests of these constituencies what becomes clear very quickly is that on many issues that bear on cost control, the interests of students and faculty align quite closely and as we will see, trustees are not far behind.

Consider the question of curriculum.

One driver of costs is what I call curricular entropy—the pressure to expand the curriculum to include more courses, more majors, more minors, and more flavors of particular subjects. Each such expansion places additional demands on faculty staffing and classroom resources by committing the institution to offer and staff subjects needed to satisfy the curriculum. Curricular entropy also creates additional demand for student advising and may lead to increases in the average time for completion of degrees as students switch majors among a myriad of choices, or worse yet, become confused about their choices and make bad decisions.[9]

Not surprisingly, students tend to favor more curricular options (as do their parents.) Indeed, in my experience, this generation of students embraces curricular optionality in part because it allows them to differentiate themselves from their peers, hence the number of students graduating with multiple majors and minors.

Faculty are often more than willing to support curricular expansion in part because it creates additional demand for faculty slots or demand for ever more specialized faculty.

Students and faculty interests are also perfectly aligned when it comes to issues of class size. Students generally prefer to take smaller classes and faculty generally prefer to teach smaller classes.

Consider class scheduling: More than one observer has noted the paucity of classes scheduled on Fridays. Students don’t like to take Friday classes and faculty don’t like to teach them. Both prefer to restrict classes to Monday through Thursday thus providing for extended weekends. The result is underutilization of our classroom resources. The same alignment of preferences tends to create excess demand for classrooms during the middle of most teaching days.

Now I do not mean to suggest that student and faculty interests are perfectly aligned. They are not. But they are sufficiently aligned around a set of core decisions regarding the curriculum, class size, and class scheduling to make it difficult to reduce instructional costs by rationalizing both the curriculum and the scheduling of classes.

Let’s take a closer look at the individual interests of students and their parents, the faculty, and trustees as they bear on issues of cost.

Students and their parents

While it is not unusual for students and their parents to rail against the high cost of tuition, one rarely hears either group advocate for specific efforts to reduce the cost of a college education other than by advocating for lower tuition.

We know how to make higher education cheaper. It is not that difficult. It involves:

- Bigger classes

- Less student-faculty contact

- Fewer curricular options

- Less in the way of costly hands-on learning

- Simpler facilities

- Less support for athletics and co-curricular life

I could go on. In all of my time as president of Tufts or chancellor of MIT not once did a student or their parent come into my office, bang the table and request that I take any of the above actions so I could then lower their tuition. To the contrary, there was always pressure to do more.

Now there are a number of explanations for this behavior. Most importantly is competition. Competition in higher education drives costs up. It does not reward the least cost provider. Institutions actually compete by advertising their relative inefficiencies. Promoting low student-faculty ratios is just another way of advertising that you are the most labor-intensive institution around. Note that institutions rarely promote the fact that they have the best learning outcomes, but they do advertise small classes, easy access to faculty, lavish facilities, and multiple opportunities for students to engage in an endless number of student organizations and activities.

The way that we price higher education also decouples price from cost. Because of public subsidies and endowment support, even full pay students and their families pay only a fraction of the true cost of their education

The way that we price higher education also decouples price from cost. Because of public subsidies and endowment support, even full pay students and their families pay only a fraction of the true cost of their education. For example, Robert J. Birgeneau, the former chancellor, estimates the true annual cost of educating a student at Berkeley is on the order of $35,000. By contrast, tuition and fees are only $13,518 annually for an in-state student.[10] The same pattern holds at most private institutions. For example, Harvard estimates that tuition, room, board, and fees cover only 58 percent of the true annual cost of educating a student.[11]

Financial aid further insulates students and their families from the linkage between price and cost. With an average discount rate nationwide of 48.6 percent at private colleges and universities, only a modest share of students or their families pay full tuition.[12] Most get some financial aid.

Please understand, I am not arguing against financial aid. Far from it. I just want to make the point that if you fix the price that any student or their family will pay out of pocket for their education, you dull the incentives on the part of students to restrain their demand for more whether it is enhancements to the curriculum or to the overall student experience.

At the margin, the way we price higher education is a classic case of third-party payment. In effect, the share of total educational costs paid for by a student or his or her family is the equivalent of an annual deductible. Once paid, there is little financial incentive to economize or avoid further consumption. So if a school has 10 study abroad programs, there will always be student demand for 11 often supported by their parents. If there are 24 varsity sports (or club sports) students will argue that the place would be better off with one or two more. Moreover, any effort to save money by economizing on the student experience is likely to be experienced by students as a takeaway even if it is accompanied by a promise to restrain future growth in tuition and fees.

It is also true that egalitarian traditions on our campuses sometimes frustrate efforts to introduce lower cost alternatives for students and their families. For example, Tufts charges all students the same amount for room and board regardless of where they live on campus. So students pay the same room fee if they live in a single in the newest dorm as they do if they live in a double in an older, less desirable dorm.

The rationale for this policy is that if housing were rationed by price, only rich students would live in newer dorms thus segregating students by wealth. But another consequence of this policy is that the inability to charge a premium for newer housing makes it difficult to generate incremental resources to both modernize and increase the on-campus housing stock. Because this policy has produced underinvestment in on campus housing as well as scarcity, many students move off campus in their junior and senior years where the private market still segregates them by their ability to pay.

By contrast, MIT does not charge uniformly for housing, and there are some low-cost options that are very popular among students who wish to minimize their cost of attendance.

Also note that our collective desire to educate more talented but financially needy students comes with a cost. This cost is not just limited to financial aid expenditures which are substantial on most campuses.[13] We now understand what it takes for first generation students to succeed academically and socially. They typically require more intensive advising, they also require investments to ensure that they not only matriculate, but they thrive and achieve their full potential. For example, at Tufts we redesigned our first year advising program to ensure that our neediest students, typically first-generation college students, were routinely assigned our best first year advisors. We also provided financial aid to our neediest students so that they could attend summer school during one of their four years at Tufts.[14] We also provided funded summer internships for our neediest students so that they could afford to volunteer in labs and other non-paying summer activities that strengthened their background for applying to graduate school. Each of these programs cost money.

To close the conversation about students and their families, we should not be surprised that they are rarely advocates for cost control because they do not see how they benefit from such efforts given the weak linkage between cost and the price of their education. Indeed, the US News and World Report rankings of colleges and universities are almost perfectly correlated with expenditures per student. So students seeking to maximize prestige are rational in selecting an institution that maximizes the difference between what they pay out of pocket and what the institution pays to educate them. And our commitment to equity in higher education also comes with costs.

Bottom line: University leaders should not look to students or their families for support in controlling college costs.

The interests of faculty

I had a colleague at MIT, David Marks, who used to joke that faculty were people who think otherwise. While this comment almost always gets a laugh, I think there is more than a bit of truth to it. While this inclination to “think otherwise” can be maddening to academic administrators, I think it is also what makes faculty great scholars.

It is what empowers them to challenge conventional wisdom in their scholarship; in their search for truth. It is what leads them to focus single-mindedly on their scholarship and to treat any distraction from their work as an assault on their professional identity.

It is what also leads them to be professional skeptics and critics, and to be articulate ones at that especially when they apply their skepticism and critical skills to pronouncements by administrators on the subject of cost control.

In pursuing their scholarship, most faculty jealously guard their control over the scholarly process. Most just want to be left alone to do their work often in an artisanal or craft like way. And here is where efforts to achieve administrative efficiencies encounter most faculty resistance.

Very few colleges and universities were designed with a goal of achieving administrative efficiency. In fact, most institutions have evolved over time in response to opportunities both intellectual and financial.

Schools, colleges, departments, institutes, programs, and centers have emerged often to capitalize on a particular moment in time and perhaps optimized to achieve a specific intellectual agenda. At the three institutions I know best, MIT, Tufts and Harvard, some research centers have evolved with the goal of recruiting or retaining unusually talented, creative and productive faculty. I suspect you have them at Berkeley as well.

The administrative structure that supports each of these academic units has also evolved to serve the faculty within it, and it has also been optimized to serve faculty within these academic units. Inevitably this process produces redundancy—whether redundant libraries, purchasing, IT or HR systems to just name a few to say nothing about additional claims on space. (It is quite common for faculty to have multiple offices—one in their home academic department and another in a center.) But these redundancies often serve individual faculty well. The faculty understand these legacy systems which have often been designed specifically to make work in their specific field or department easier. Moreover, these systems are managed by people who are known to the faculty personally and the staff who manage them know the faculty as well.

In this context, efforts to achieve administrative efficiency often involve centralization and reengineering of work. In fact, most consultants engaged by universities to identify administrative efficiencies focus on the same set of recommendations: centralize purchasing, IT, and administrative support. From the faculty’s perspective, this means giving up something that is familiar for something that is not. It means dealing with new people. It means learning new processes. It means accepting on face value a claim by the administration that better service will be delivered in the future and at lower cost. Most importantly, faculty fear that any efficiency gains will come at the expense of their own personal time, time they believe is better devoted to their scholarship. So skepticism and resistance to this kind of change should not be surprising. When viewed through the eyes of an individual faculty member it is not irrational although it may be self-serving, globally inefficient and very expensive.

Faculty also frequently engage in guild like behavior to protect faculty employment. Perhaps the best example of this that I have ever seen was at MIT. MIT requires every first-year student, regardless of their major, to take among other things, a year of physics and a year of calculus. The physics and math departments jealously guard their privilege in teaching these courses. They insist that only subjects offered by their faculty in their departments should be accepted to satisfy these Institute requirements. In fact, they have successfully thwarted efforts of engineering departments to offer subjects that would satisfy these requirements even when those subjects were taught by engineering school faculty members who held PhDs from the MIT physics or math departments. So the issue is not whether engineering faculty are qualified to teach these subjects.

We have seen similar guild like behavior by faculty at a variety of schools objecting to efforts to expand online education on the grounds it will reduce faculty employment. For example, faculty at San Jose State objected to the teaching of an online version Michael Sandel’s Justice course on precisely these grounds.[15] And at Harvard, some faculty have voiced concern over the creation of online content to be used elsewhere because it might reduce employment opportunities for Harvard trained PhDs.[16]

Most of us who have been in academic leadership positions have experienced resistance to efforts to reallocate faculty slots freed up by retirement to better reflect current enrollments or intellectual challenges. Faculty in certain fields will routinely defend department level staffing in the face of declining enrollments, declining research support, or increased intellectual excitement in related fields.

Most of us who have been in academic leadership positions have experienced resistance to efforts to reallocate faculty slots freed up by retirement to better reflect current enrollments or intellectual challenges.

This guild like behavior reduces flexibility in deploying faculty resources and further drives up instructional costs.

There is another dimension to faculty behavior that also contributes to skepticism about centralized efforts to control costs. In the 40 years since I became a junior faculty member at MIT I have noticed a steady drift in identification of faculty away from their home institutions and more towards their disciplines. I also have observed this trend towards stronger disciplinary association at Tufts and at Harvard. I think this disciplinary identification stems from a number of factors.

As tenure has become harder to obtain, faculty have understandably invested more of their time seeking to establish their reputations among colleagues within their own disciplines. To put it another way, they are less likely to be citizens of their institutions than they are to be members of their own disciplines. And as resources have become scarcer, universities have had less in the way to offer individual departments.

Since cost control usually entails more centralization, this disciplinary focus has made it harder to get faculty to adopt a more school or university wide perspective. To put it more colloquially, this disciplinary orientation makes it much harder to get people to “take one for the team.”

It is again worth noting that faculty interests exactly parallel student interests when it comes to class size, schedules, curricular expansion, improved teaching and research facilities, support for graduate students, etc.

Bottom line: Faculty are rarely, if ever, allies in efforts to curb costs.

The interests of trustees

So if faculty and students are unlikely to be allies in support of cost control, what about trustees? Surely as fiduciaries they have a legal obligation to ensure that a university lives within its means.

In thinking about trustees it is important to recognize that they are rarely selected because of their higher education subject matter expertise. Most know relatively little about the nuts and bolts of running a university. They often do not understand academic culture. They don’t understand or appreciate shared governance. They have little knowledge of what faculty do on a day-to-day basis. They don’t understand the fact that research, graduate education and undergraduate education are joint products so they do not appreciate that they cannot economize in one area without having serious consequences in another. They are mystified by the complexities of fund accounting.

I could go on. My point is that while trustees may be sympathetic to the need to realize efficiencies and control costs, they often lack the organizational sophistication to understand how contemplated changes may actually affect an academic institution. Moreover, they are often naïve in recognizing the constraints under which university leaders operate. For example, when confronted with faculty resistance to centralization of certain administrative services, a common trustee response is to suggest that the president just order the faculty to comply. Such orders tend to make for brief presidential tenures.

Trustees also have interests other than simply balancing the budget. They are the stewards of a school’s reputation, and most care passionately about their institution. They devote personal time, resources and expertise to try to advance its interests. Consequently, they are highly motivated to enhance their university’s reputation and would be mortified if it declined on their watch. This is why trustees are often willing to back a president who wants to make substantial investments in faculty, students and facilities even in relatively challenging economic times. In this sense the interests of trustees align quite closely with students and faculty.

It is also why they are inclined to look for other ways to address budgetary pressures than simply engaging in cost control. Revenue enhancement, often through fundraising, tends to be their first line of defense.

But fundraising, if not carefully done, can be very expensive. Rare is the gift that pays 100 percent of the marginal cost of a new activity. There are always additional expenses including support staff, space, overhead, IT, as well as demands on the curriculum. Gifts that don’t go to support core needs often wind up taxing the unrestricted resources of the institution. And even when a gift endows a new activity completely, there may still be shortfalls. Endowments go up and endowments go down. When they decline, the institution is left with 100 percent of the liability to the donor and only a fraction of the resources needed to support the new activity.

To put it another way, if you are not careful, capital campaigns can actually weaken institutions financially. The true measure of success is not how much money you raise. In fact, if you raise money for the wrong purpose, the more you raise, the bigger the hole you may dig.

Rather, to be successful, a campaign must accomplish two things simultaneously: it must strengthen the institution intellectually and it must strengthen it financially. The latter requires raising support for core intellectual activities that the institution is committed to offering regardless of the preferences of donors, or alternatively, raising resources that are either unrestricted or budget relieving.

Another way to enhance an institution’s reputation (and revenue) is to increase its research volume. However, because of under-recovery of indirect costs, research also does not pay its own way. So as trustees support efforts to enhance their institution’s scholarly reputation by building research volume, they may also build gaps into their budgets that need to be filled from other sources.

Beyond fundraising, the only revenue source trustees control directly in most institutions is tuition. In most research universities, there are five or six major sources of revenue depending on whether they are public or private:

- Tuition, fees and revenue from auxiliary operations (e.g., room and board)

- State appropriations

- Research support

- Income on the endowment

- Gifts for current use

- Intellectual property revenue

Currently, all of these revenue sources are under economic, political or market pressure.

In good economic times, there is relatively little pressure to rein in tuition. This statement better describes private institutions that are relatively insulated from political pressure, but it is also true to some degree for publics. Trustees may fear that if they forgo a tuition increase in a given year that the revenue increment “will be lost forever” due to the impact of compounding. Also, unlike markets for other goods and services, the higher education market (especially among highly selective colleges and universities) is notoriously price insensitive. So there is little advantage competitively to underpricing one’s competitors in good times.

By contrast, in tough economic times when trustees and administrators are trying to close a budget gap, tuition is the only revenue source controlled directly by the board so there is pressure to raise it to produce incremental revenue.

So in good times or bad, tuition tends to go up.

Now one important distinction between public and private universities is that in the case of the former, trustees or regents are either appointed by the governor or elected directly on party affiliated ballots as they are at the University of Michigan. By contrast, trustees at private institutions are either selected by a self-perpetuating body or directly elected by alumni.

In the case of public university regents or trustees, a common pathology is for some of these individuals to view themselves as more fiduciaries of the taxpayer and less of the institution. Some campaign for their positions specifically on a platform to cut waste and inefficiency and reduce the cost of higher education. These individuals are the relatively rare exception to my argument that trustees have priorities other than cost control. But it is also true that these individuals can be very disruptive to institutions and their boards as our colleagues at the University of Texas have recently learned. Such trustees have very narrow agendas and often have little respect for the scholarly mission of higher education. In fact, they tend to focus exclusively on the price of undergraduate education without understanding the complexities and interrelationships between undergraduate education, graduate education, and research. Furthermore, they tend to undervalue the public mission of higher education.

Economists (present company included) are sometimes accused of knowing the price of everything and the value of nothing. Trustees who only care about balancing the budget or reducing costs are also sometimes guilty of this conceit.

* * * *

I have argued that one important reason that cost control is not a higher priority on most university campuses is that there is not a natural constituency for it among students, faculty, staff and trustees with some notable exceptions.

It is also true that external constituencies are often advocates for activities that drive costs up.

It is certainly true that federal regulation has been a source of additional administrative cost whether it is reporting and compliance requirements for research or Title IX, or the elimination of mandatory retirement for tenured faculty to name just a few examples. There have been some clumsy efforts to estimate the magnitude of these costs at Vanderbilt[17]. While the methodology left a lot to be desired, few would argue that compliance with federal regulation adds to our cost structure. The only question is by how much.

But in addition to federal regulation of higher education, it is also true that local government is constantly asking our colleges and universities to do more in service to the local community. Beyond payments in lieu of taxes, host communities also typically want more access to university facilities, more support for local schools, preference in admissions for local graduates, earmarked financial aid, etc. I could go on.

But in addition to federal regulation of higher education, it is also true that local government is constantly asking our colleges and universities to do more in service to the local community.

My point is that while colleges and universities are typically very good at doing more with more, increasingly they are being asked to do more with less. Everyone wants us to contain our costs but at the same time no one seems willing to moderate their expectations of what we provide for society collectively or for them individually.

So if students, faculty and trustees are not likely to be major sources of support for cost control, what explains the success of some institutions to rein in costs?

The Lincoln Project, created under the auspices of the American Academy of Arts and Sciences and co-chaired by former Berkeley Chancellor Robert Birgeneau (Henry Brady also played a major and important role), studied the future of the public research university. It reported that education and related expenditures grew only one percent annually on a per student basis at public research universities from 2000 to 2012.[18]

Moreover, the Delta Cost Project of the American Institutes for Research found that in 2012, public research universities actually employed 30 fewer staff per 1000 FTE students than in 2002. By contrast, private research universities employed an additional 137 staff per 1000 FTE students.[19]

So it is possible to contain costs notwithstanding the alignment of the interests of students, faculty and trustees previously noted. What explains the success of public institutions in controlling costs (note, prices went up in this period due to the reduction in public support) and the failure of private institutions to achieve these same efficiencies?

I think the answer lies in an important observation made by the late Howard Bowen, a distinguished economist of higher education and the former president of Grinnell College, the University of Iowa, and the Claremont Graduate University. Bowen formulated what has become known as Bowen’s Law or more precisely, Bowen’s Revenue Theory of Costs.[20] Bowen argued that the unit cost of education is determined by the amount of revenue currently available for education relative to enrollment. In other words, higher education institutions spend on education essentially what they take in. Institutions that have very different revenue streams spend radically different amounts to educate the same students.

Another way of understanding Bowen’s Revenue Theory of Costs is that only severe and sustained revenue shortfalls create the kind of sustained political pressure necessary to bring about reductions in costs through efficiencies on college campuses.

I think this theory does an excellent job of explaining why public institutions fared far better than their private counterparts in reducing administrative costs during the period 2002-2012. While both sectors suffered a decline in investment revenue during the Great Recession, public institutions also saw a dramatic reduction in state support. As I am sure Bob Birgeneau will acknowledge, absent such a reduction, it is far from clear that Berkeley or any other institution could have mustered the internal political will to achieve the kind of administrative efficiencies produced during this period.

* * * * *

So I fear I have painted a rather bleak picture. While I do think cost control is hard—perhaps very hard, I don’t think it is impossible. Moreover, I do not wish to be heard arguing for further reductions in public support merely as a way of controlling costs. Far from it.

First, I think technology offers us some opportunities. I started this lecture by noting that the production function for higher education has changed little in hundreds of years. The result is that we have not experienced significant productivity growth and so, as Baumol and Bowen have predicted, our costs have risen faster than inflation.

As I mentioned earlier, while I don’t believe online learning will replace traditional bricks and mortar institutions, I do think we can learn from some of the current experiments with an eye towards reducing costs. For example, MOOCs have developed some very successful models for crowd sourcing both grading and advising.

I subscribe to the old maxim that faculty teach for free. We are paid to grade. Using technology to reduce the burden of grading would not only be popular with faculty, it would also boost productivity. The same can be said for advising. I know of few faculty that would fight if asked to give up the burden of advising undergraduates. Technology can help to improve productivity in this area and we should take advantage of it.[21]

Similarly, MIT has successfully implemented a virtual lab for a version of its introductory circuits and design course required of all first-year electrical engineering majors.[22] Virtual labs not only reduce the cost of constructing expensive teaching laboratories, they can also reduce the demand for TAs and technical instructors. We need to study these experiments and make realistic judgments about the magnitude of possible cost savings.

Technology also allows us to connect students with real time tutors that are physically removed from the campus. Imagine teaching languages where the tutorials are conducted by native language speakers who happen to reside in their own countries—for example, Urdu taught with the assistance of tutors in Pakistan. Admittedly, this is not a productivity enhancement, but it might be a way to deliver higher quality instruction at a lower cost. And if we can do it for languages, we can do it for lots of other subjects where talent exists in industry. Indeed, we may have opportunities to use technology to forge bonds between our students and our alumni while also improving the pedagogy. Harvard Law School has pursued precisely this strategy in teaching an online class on copyright law that employs alumni who are practicing in the field as virtual section leaders.[23]

I don’t mean to oversell the prospect of technology. To be sure, there are costs associated with each of these strategies. That said, we need to be open to doing things differently and look for opportunities to both lower costs and build relationships (like with our alumni) or ease the administrative burden on our faculty. I think there are opportunities to do both.

We also have to be willing to have open conversations with the faculty about how the fruits of productivity gains made possible through technology are to be shared. Currently, I fear faculty believe that any enhancement to productivity will come at the expense of faculty employment. It need not. As I have previously noted, we can use these enhancements to relieve faculty of activities they find burdensome. We can also devote some productivity gains to educating more students, something I think would help to rebuild public support for higher education.

Second, if competition drives costs up in higher education as I think it does, perhaps the time has come for a bit less of it.

We need more cooperation among institutions in shared scientific facilities, in libraries, in purchasing, in graduate student housing, and in the provision of back of the house services that are not particularly strategic but that could be more efficiently provided if done at a larger scale. For example, Boston University, Harvard, MIT, Northeastern University, and the University of Massachusetts have collaborated to create the Massachusetts Green High Performance Computing Center, a state-of-the art facility for computationally intensive research that is open for use by any research organization. We need more such collaborations.

As the Lincoln Project persuasively argued in my opinion, we also need more cooperation among institutions on the curriculum. We need not replicate every major and every area of research at each neighboring institution. Such competition drives up costs for everyone. More regional compacts in which institutions agree to specialize in certain fields but provide access to students and faculty from neighboring institutions are needed. There are many examples of such cooperation—the Claremont Colleges are a good example in southern California. In Massachusetts, Amherst, Williams, Smith, Mount Holyoke, and the University of Massachusetts have participated in a successful exchange program for decades.

Let me now say something controversial but that I think needs to be said. I believe institutions should cooperate to rethink the terms of tenure and to perhaps limit it to a fixed term contract, perhaps 35 years from the date first granted to an individual at any institution.

Congress eliminated the exemption for mandatory retirement for tenured faculty in 1994. At that time, no faculty member who held tenure had any expectation that they would not have to retire upon reaching the age of 70. Thus, eliminating mandatory retirement resulted in a windfall gain for all faculty tenured at the time including me. But the elimination of mandatory retirement also has had other consequences for higher education. An aging faculty limits opportunities for intellectual renewal.

Without faculty turnover, it becomes harder to commit resources to new fields of intellectual inquiry. Job prospects are also reduced for younger colleagues. Elimination of mandatory retirement has also made diversifying the faculty that much harder. If you look at faculty over the age of 75, they are a far less diverse group than those who are being hired to replace them.

Eliminating mandatory retirement has also increased costs for institutions in at least two ways. As the faculty has aged as a group, faculty salary costs have increased if for no other reason than it costs more to employ senior faculty than junior faculty. Also, many faculty will not retire absent financial incentives. It has become common for institutions to offer retirement programs simply to get faculty to give up tenure.

Beyond being expensive, these programs are often regressive from an institutional perspective. In effect, we are making payments to colleagues to give up a windfall they never expected in the first place, and these colleagues are often the wealthiest among us. They bought their housing when it was relatively cheap, sent their kids to college when it was far less expensive in real terms, and they have been the beneficiaries of a very strong equity market which has provided them with relatively generous retirement savings.

I know of no college or university president who thinks eliminating mandatory retirement for tenured faculty was a good idea. However, for both political and competitive reasons, no individual institution can act to change this policy on its own. Any president who took on this challenge would be immediately challenged by his or her own faculty. And any institution that tried to redefine the terms of tenure on its own would face resistance in the very competitive job market for faculty. Collective action is required.

Redefining tenure going forward as a 35-year contract from the time first granted at any institution would not require federal legislation because it would not run afoul of legislative restrictions on age discrimination. It also would not affect those currently holding tenure. After 35 years, faculty would still be eligible for a term appointment assuming they still met appropriate expectations for teaching and scholarly productivity. But such action requires a collective conversation. I believe we should start that conversation now.

Third, we need to raise money in ways that generate financial flexibility for our institutions. This requires doing a much better job of explaining to donors who really care about our institutions how they can help to strengthen them both academically and financially. We need to get them to underwrite the core mission of the university, not simply partially underwrite expensive new initiatives. The Hewlett gift that Bob Birgeneau secured for Berkeley to create 100 new faculty chairs is exactly the kind of philanthropy I am talking about.[24]

Finally, let me turn to the general lack of political support for cost control.

We are unlikely to change the underlying incentives faced by students, faculty or trustees. However, academic leaders can do a better job of framing choices so as to reveal their true consequences.

During my tenure at Tufts, with the concurrence of the faculty and the board, I made undergraduate financial aid our highest priority. Each time I was asked to expand a program or to otherwise incur new costs in support of some otherwise worthy objective I would restate the cost of the proposed new program in financial aid award equivalents. Thus, when students pressed me to make the entire campus Wi-Fi accessible (remember, this was before the days of ubiquitous smart phones and internet access) I responded by asking if they were willing to deny a Tufts education to three prospective students so they could sit under any tree on campus with their laptops and surf the web?

Similarly, during the financial crisis it was clear to me we were going to have to freeze all salaries. I could have just done it and there would have been grumbling but probably grudging acceptance. Instead, I framed the choice in real terms. We could either freeze salaries or lay off 200 of our colleagues in the worst job market since the Great Depression. People understood the reality of this choice and accepted the salary freeze willingly.

Brit Kirwan, the very able former president of the University of Maryland system succeeded in successfully negotiating additional support from the Maryland legislature to fund some important new initiatives by conditioning that support on the university achieving specific targeted reductions in expenditures. Framing additional state appropriations in this way gave everyone on campus an interest in undertaking change, even change that was viewed skeptically by many.

It is through framing choices that I believe we can do better to generate at least some support (or perhaps understanding) of the need for cost control.

It is through framing choices that I believe we can do better to generate at least some support (or perhaps understanding) of the need for cost control. We need to do a better job of educating our donors and our trustees, and we need to give faculty a stake in harvesting efficiency. We need to demonstrate that only by making better use of technology, enhancing productivity, rationalizing parts of the curriculum, and by giving academic leaders more flexibility to make the university more efficient will we find the resources to support future investments in students, faculty and the scholarly enterprise.

We cannot assume that these investments will come from ever rising tuition, larger investment returns, newly discovered revenue sources or a miraculous restoration of public funding. I believe the real choice for higher education writ large is whether to find a way to bend the cost curve or jeopardize all of public support for higher education. And no one has a bigger stake in this decision than the faculty. They are the university.

Clark Kerr in The Uses of the University said, “The call for effectiveness in the use of resources will be perceived by many inside the university world as the best current definition of evil.”[25] I hope you don’t think me evil. I am under no illusion that this process will be easy or popular, but I think it is necessary to preserve this great institution that we all love and that I believe has done so much good for this country, the research university.

Toward Sustainable Financial of Higher Education

Richard C. Levin

May 18, 2017

During my years as a student at Lowell High School in San Francisco, Clark Kerr was at the height of his distinguished career. Between 1960 and 1965, he dedicated three new University of California campuses—San Diego, Santa Cruz, and Irvine, expanding the capacity of the state to serve the burgeoning baby boomer generation.

He published The Uses of the University in 1963, still after a half-century the definitive text on the purpose and practice of the American research university. I am deeply honored to give this lecture in his memory.

The essays compiled in The Uses of the University were written initially as the Godkin Lectures and delivered at Harvard. That so comprehensive and insightful a work could be authored by a busy president of the nation’s largest university system should be an inspiration to us all. The obligations of my current work as the CEO of an internet startup pale in comparison, and yet, where Kerr produced a comprehensive statement, the best I can do is offer just a few ideas about one of the many issues currently bedeviling those of us who care about the durability and viability of the American research university.

The problem I wish to tackle is the sustainable financing of the university. The solutions I offer are not comprehensive, but I hope that they are helpful.

The rising costs of higher education

We all know that the cost of higher education, as well as the tuition and fees that families pay, tends to rise faster than inflation. But why? Two distinguished Princeton economists, William Baumol and William Bowen, provided the explanation of this persistent phenomenon a half-century ago. They did so with reference to the performing arts, but the same logic applies to education.

The idea is simple. Productivity (the amount of output per worker) tends to increase over time in many sectors of the economy. Think of how little labor is required to produce a gigabyte of computer memory, compared to thirty years ago. Consequently, the price of computer memory has declined. By contrast, there is no productivity growth at all in chamber music. Labor input (a quartet, for example) stays constant over time, and, unless the size of the concert hall grows, output (in the form of tickets sold) also remains constant over time. If wages of musicians rise, ticket prices have to rise to cover cost.

Since inflation is just an average of all price changes in the economy, prices in sectors with high productivity growth will rise more slowly than inflation, while prices in sectors with low productivity growth (such as the performing arts) will rise faster than inflation

As long as we continue to teach 15 students in a seminar and 100 students in a lecture course, and a faculty member’s teaching load does not increase, the price of educational services will rise faster than inflation.

The dynamics are no different in higher education. As long as we continue to teach 15 students in a seminar and 100 students in a lecture course, and a faculty member’s teaching load does not increase, the price of educational services will rise faster than inflation. Put differently, without an increase in the ratio of students to faculty, we are doomed to increases in the cost of educating a student.

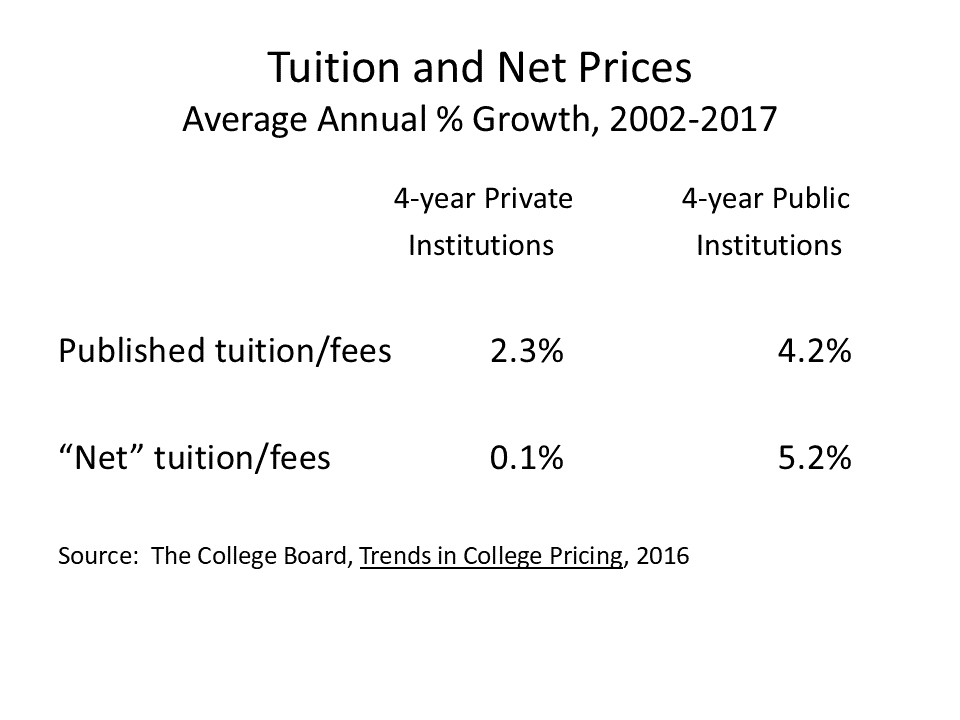

Students and their families suffer from this absence of productivity growth. Over the past fifteen years, published tuition and fees at four-year public universities in the United States have increased at average annual rate of 4.2 percent, after adjusting for general price inflation. Moreover, financial aid to students has declined as a percentage of tuition and fees, so that the net price of attending a public university (that is, tuition and fees minus financial aid) has increased 5.2 percent per year, after adjusting for inflation.

Can rising costs be contained? One mitigation strategy is to increase government subsidy in the face of inevitable increases in cost. A second is to leave student-faculty ratios alone but reduce costs and increase efficiency in other aspects of the university’s operation. In this lecture, I will offer thoughts in both these areas.

Can the tendency to rising costs be reversed? The answer is yes, but this requires increasing the productivity of the university’s scarcest resource—its faculty. I have some thoughts on this subject as well.

My plan in this lecture is to explore each of these possibilities in turn: increasing government subsidy, allocating resources more efficiently, and scaling the productivity of faculty.

The erosion of government support for higher education

One potential offset to the rising cost of higher education would be increased public subsidies. Even though there is a substantial private economic return to higher education, typically estimated to be on the order of a 70 percent increase in lifetime income, there remains a good case that the social benefits exceed the private benefits. A better-educated labor force improves the competitive posture of the national economy, and a better-educated citizenry, it has long been thought, strengthens our democracy.

Even though there is a substantial private economic return to higher education, there remains a good case that the social benefits exceed the private benefits.

But, in truth, public subsidies have not been increasing to offset rising costs. Instead, their decline has exacerbated the problem and led to tuition and fees rising even faster than increases in the cost of education.

This decline in government support for higher education has been widely noted. In the mid-1970s the State of California general fund covered roughly one-third of the budget of the UC system. Three decades later, that number had been cut in half to 16 percent. It is closer to 10 percent today.

The pattern is similar around the country. About six percent of the budget of the University of Virginia is supplied by the state, and the number at the University of Michigan at Ann Arbor is even lower, at 4.4 percent.

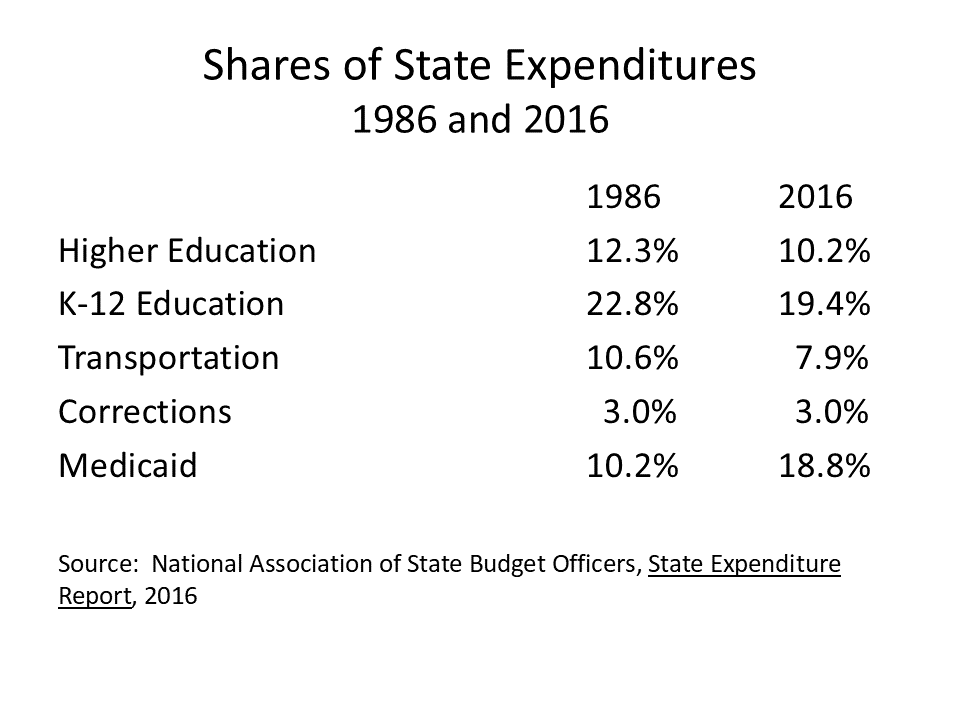

Another way to look at this is through the lens of state, rather than university, budgets. Allocations to higher education have declined from 12.3 percent of state budgets in 1986 to 10.2 percent in 2016. We’ve seen a decline of nearly the same proportion in K-12 education, from 22.8 percent to 19.4 percent. Infrastructure investments have declined similarly.

What has replaced spending on education in state budgets? Surprisingly, not prisons. The share of state expenditures going to corrections was three percent 30 years ago and remains three percent today. The answer is health care. Medicaid has nearly doubled as a proportion of state budgets, from 10 percent to nearly 19 percent.[26]

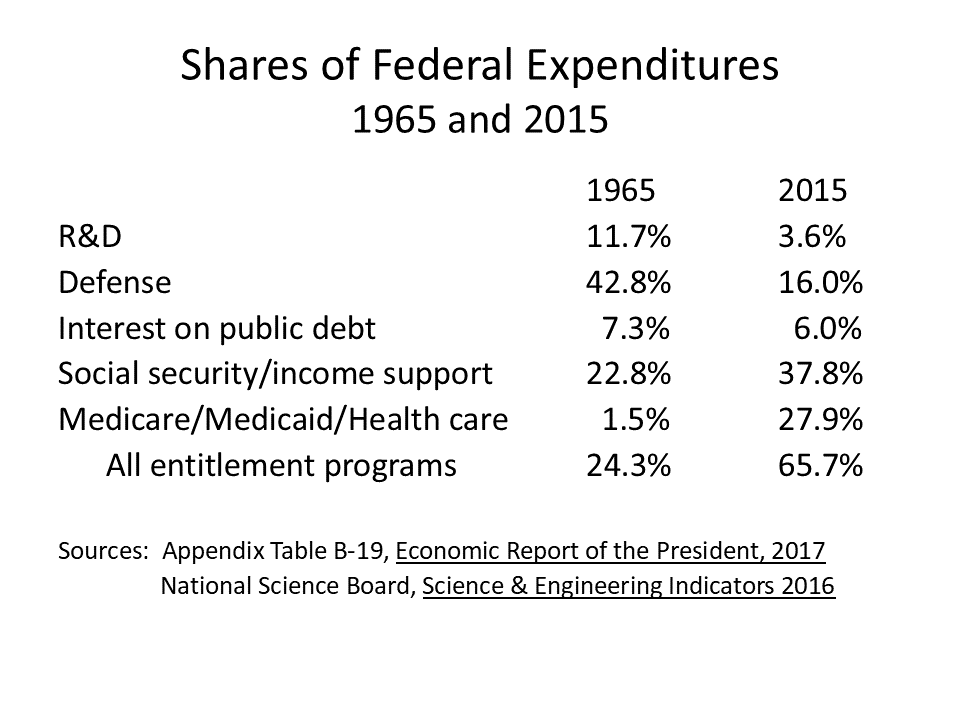

Federal support for universities has been eroding, too. In the 1960s, at the height of the Cold War and the race to reach the moon, research and development accounted for nearly 12 percent of all Federal expenditures. Fifty years later, only 3.6 percent of Federal expenditures go to R&D—a 70 percent decline in R&D’s budget share.

Defense spending has also declined dramatically—from 42.8 percent of the Federal budget to 16 percent, a relative decline of just over 60 percent.

Where did the money go instead? One might think it has been needed to cover interest on our growing public debt, but no. Interest rates are lower than a half century ago, so that interest expense has actually declined slightly as a percentage of the budget.

The answer is entitlements. Social security and income maintenance programs (largely Aid to Families with Dependent Children before 1995, and largely Social Security Disability Insurance today) accounted from 37.8 percent of the Federal budget in 2015, as opposed to 22.8 percent in 1965. Even more dramatically, health care programs including Medicare and Medicaid represented only 1.5 percent of the Federal expenditures in 1965; today health care absorbs nearly 30 percent of the budget. Taken together, these entitlement programs have grown over a half-century from one-quarter to two-thirds of the Federal budget.[27]

Private colleges and universities, which are less reliant on government and more reliant on philanthropy, have been able to respond more effectively to rising costs than their public counterparts. Starting from a much higher base level, private institutions have held inflation-adjusted tuition and fee increases over the past fifteen years to a still unacceptably large 2.3 percent annually, as compared to 4.2 percent for public institutions. But the privates have managed to increase financial aid as rapidly as they have increased tuition, so that the “net price” (tuition minus financial aid) has increased only 0.1 percent per year for the past decade and a half. By contrast, under the pressures of diminished state and Federal support, the “net price” charged by public institutions—the actual out-of- pocket expenditures of parents and students—has increased a full percentage point faster than published tuition and fees.[28]

If, in the end, we wish to rely on increasing levels of government subsidy to offset the rising costs of public education, we have a very steep hill to climb.

If, in the end, we wish to rely on increasing levels of government subsidy to offset the rising costs of public education, we have a very steep hill to climb. The capacity of our nation to invest in education, research and infrastructure has been eroded by the inexorable growth of entitlements in general and the cost of health care in particular. And our limited capacity to invest in the future has been further diminished by the aging of our population. The lesson is clear: if we wish to invest in the future, and make public education sustainable, we need to control the cost of health care. Or, put more bluntly, if we want to fix education, we need to fix health care first.

The efficient allocation of capital

Let me turn now to a second route toward the sustainable financing of higher education: the efficient allocation of capital across various uses. To begin, it is important to recognize that universities accumulate and maintain three types of capital: financial capital in the form of endowments and reserves, physical capital in the form of buildings and equipment, and human capital in the form of faculty and staff. Each of these types of assets is subject to erosion in value: financial assets decline in purchasing power if investment returns do not keep pace with inflation; buildings deteriorate if they are not renovated at regular intervals or replaced, and faculties and support staff decline in quality (and hence in value) if new recruits are below the standard of those who depart or retire. Maintaining a non-diminishing stock of each of these assets is an essential requirement for a university that wishes to maintain the quality of its research and educational programs.

To pull these ideas together, we might define a sustainable, or stationary equilibrium as one in which a university maintains constant-valued stocks (when adjusted for inflation) of financial, physical, and human assets over a period of time, and its streams of operating income (tuition, gifts, grants, and contracts, as well as medical service and other income) are also constant (in inflation-adjusted terms) over time. In such circumstances, the university will have the capacity to maintain the quality of its academic programs.

Even more interesting is the concept of a dynamic, or steady state equilibrium—a condition in which the stocks of financial, physical and human assets as well as current income streams grow over time at constant rates, and the quality and/or scope of academic programs grow accordingly. This framework makes it possible to plan for balanced growth involving investments in financial, physical and human capital. To make matters simpler, let’s just focus on achieving a sustainable equilibrium for now.

When I assumed my duties as Yale’s president, the university already had a well-defined approach to maintaining its financial assets. The Yale spending rule, based on the work of Nobel-laureate James Tobin, is intended to preserve the real purchasing power of the endowment over time by setting a target rate of spending equal to the long-run expected rate of return on investment, net of inflation.

Fluctuations of asset prices are smoothed by a partial adjustment formula that puts some weight on last year’s spending and the balance of the weight on the value of the endowment times the target rate of spending. The Yale spending rule is now used in most peer institutions.

Financial assets are measured in inflation-adjusted dollars, but it is much harder to measure directly the accumulation or depreciation of a university’s stock of human capital. Instead, we use proxy measures: the rankings of departments and schools, scholarly citations by field, success and failure in faculty (and staff) recruiting and retention, admissions selectivity and yield across departments, schools and programs. If we are willing to look hard enough, and if we are honest with ourselves, we can tell which parts of the university are slipping and which are improving. And we can use that information to decide whether to double down on success or turn around a decline.

The type of capital that is most typically neglected is physical capital. When I became president, Yale had just completed a survey of its facilities and concluded that we had a backlog of deferred maintenance in excess of $2 billion in today’s dollars. It was clear even then that the survey’s methods had biased that number downwards. In truth, our facilities—architecturally among the most distinguished in America—were in disastrous condition. A large fraction of the campus had been built between the two world wars; many buildings had not been significantly repaired or renovated over the next 50 years.

Under-maintenance of facilities is a pervasive problem on most university campuses, and in most elementary and secondary schools as well. The problem is that we fail to recognize the true cost of facilities. This leads to a pervasive bias. We build too many buildings, because we look only at their initial construction cost and not the cost of maintaining them over a full life cycle. And once we build buildings, we under-maintain them, because we fail to provide for those ongoing maintenance costs.

When I became president of Yale, I set about to fix this problem, but we had a long way to go. Prior to 1991, universities and other nonprofits typically failed to account for depreciation of facilities in their financial statements and budgets. After a rule change by the Financial Accounting Standards Boards, institutions began to report conventional depreciation charges, based on the original cost of assets. But original or historic cost depreciation understates the true cost of using a building. Let me explain why a different approach is needed to provide the right incentives to allocate resources efficiently between financial, physical, and human assets.

Under conventional cost accounting, for a building with an expected forty-year life, one-fortieth of the initial construction cost, in nominal dollars, would be recorded as an expense each year for forty years. Depreciation is a non-cash expense. So if its budget were balanced (and we abstract from other non-cash revenue or expense items), a university would have cash available for reinvestment in facilities equal to the depreciation charge. But even if all such cash were reinvested in facilities annually, it would not be enough to prevent the decline in the value of physical assets, because the cost of renovation and replacement in the future rises over time in nominal dollars.

To illustrate, suppose we build a building that costs $40 million to construct and requires a steady stream of maintenance, repair, and renovation each year for forty years. Suppose the amount of work required costs $1 million in year one.

Under historical cost accounting we would charge ourselves $1 million nominal dollars per year as the cost of using the building. In year one, the cash flow generated by the depreciation charge would be sufficient to pay for the renovation required. But if construction costs grow at, let’s say four percent per year, in year twenty, repairs will cost $2.2 million, and in year forty, the funds needed grow to $4.8 million. A nominal stream of $1 million per year will fall far short of maintaining the building.

This example illustrates one key point: that depreciation charges, the cost of consuming physical capital must be inflated upwards annually to reflect rising construction costs. This is a necessary condition for measuring the true cost of capital consumption, but it’s not sufficient, because, under conventional accounting, rules, rather than economic logic, dictate the time period over which depreciation is charged.

At Yale we tackled this problem from first principles. We set out to estimate the true cost of maintaining and replacing our facilities. We commissioned an engineering study of each of several building types: residences, office buildings, classroom buildings, and laboratories. We then developed a schedule for maintaining each type of building over an eighty-year life cycle, asking questions like: at what intervals would you replace the electrical system, the HVAC system, the roof, and so on. We took into account savings that were possible by replacing more than one system at the same time, and of working on more than one building at the same time. The result was, for a typical non-laboratory building, a significant renovation after twenty years, a comprehensive renovation after forty years, another less comprehensive renovation after sixty years, and replacement after eighty years. To finance such a program, we asked: what percentage of a building’s current replacement cost would we have to charge ourselves each year to cover the full life cycle?

The answer varied by building type, ranging from 2.3 percent per year for classroom buildings to 3.4 percent per year for laboratory buildings. Aggregated over all buildings, the average was 2.7 percent in 2002, when the study was completed.

Next we asked the question: what is replacement cost of our current stock of buildings? To estimate this, we multiplied the current cost per square foot for new construction of each building type times the square footage of each building type, and summed up across building types. We eliminated buildings that we believed we would never replace.

We knew that the results would be scary, and we weren’t disappointed. It turned out the replacement value of our campus in 2002 was roughly $5.5 billion, three times the “book” value reported in our financial statements. Correspondingly, 2.7 percent of this total, or $151 million, represented the true cost of capital consumption—more than double the conventional accounting depreciation charge reflected in our financial statements.

Our hope was that over time, we could move gradually toward funding this true cost of capital replacement from our operating budget. This would be a steep hill to climb for an institution, but by moving in the right direction, however slowly, we knew that if we recognized the true cost of buildings we would build fewer, maintain them better, and save money overall.

We had begun to implement a capital replacement charge in 1995 by adding gradually to the amount provided from the operating budget for renovations. By 2002, when our systematic study was completed, this annual provision had grown from $3.5 million in 1995 to $95 million in 2002.

Today, 22 years after we began to fund capital replacement, Yale has reached a full, sustainable equilibrium. Because we have built a number of new buildings since 2002 and acquired a new campus nearby, the “true” annual cost of capital consumption now stands at $227 million. Renovation investments in the current fiscal year will equal this amount, with 93 percent of the funding coming from operations and gifts for renovation.

Why does all this matter? In the short run, underfunding capital replacement allows buildings and laboratory facilities to deteriorate, potentially diminishing the quality of research and education, and placing a huge burden on future generations to cover the true cost of serving those before them. More fundamentally, by not recognizing the true cost of maintaining the quality of a building, we make the upfront investment appear artificially cheap and thus tend to overbuild—spending on new buildings money that would be more efficiently spread over both academic programs and maintaining existing facilities.

By not recognizing the true cost of maintaining the quality of a building, we make the upfront investment appear artificially cheap and thus tend to overbuild—spending on new buildings money that would be more efficiently spread over both academic programs and maintaining existing facilities.

Let me dwell for a moment on this last point. When we build a $100 million building, we are not only spending the $100 million. We are also incurring a future cost of roughly $2.7 million annually, growing at the rate of construction cost inflation. This stream of costs equals the amount required to maintain the building for the future and eventually replace it. At Yale, when a dean proposes to build a new building, we make her aware that, once the new building is completed, her budget will be charged 2.7 percent of the initial cost of the building, and that amount will be inflated each year. We coined the phrase “capital replacement charge,” and for internal budgeting and management, we ignore conventional depreciation and use CRC instead.

Another way to think about this would be to convert the stream of annual capital replacement charges into an endowment to cover them. At a five percent target spending rate, a $100 million building would require a $54 million endowment to support its maintenance. To sum up, prior to changing our regime at Yale, buildings looked cheap in comparison to their true cost. This mispricing resulted in too many buildings and too little maintenance of them. To finance a university sustainably, capital replacement charges are an indispensable tool.

Scaling faculty productivity through online education

Neither increased government support nor efficient capital allocation can prevent the cost of higher education from rising faster than inflation. Government support can slow the rate at which tuition grows, and improving the efficiency of capital allocation can slow the rate at which costs increase. But to turn things around, we need to confront the problem at its source. We can only increase productivity over time by increasing the number of students educated per faculty member. You will not be surprised to hear from me, as CEO of the world’s largest platform for online university courses, that technology can provide the solution.