A State-by-State Snapshot of Stranded Credits Data and Policy

As the higher education sector begins to address the adverse effects of the pandemic on enrollment, institutions and policymakers alike have begun to turn their attention to a pernicious form of debt that could be preventing over six million students, especially low-income students and students of color, from re-enrolling and earning their degrees. This form of debt prevents students from accessing their transcripts at institutions they attended in the past, leading those previously earned credits to become “stranded” at the student’s prior institution. For many students, even small fees can be a major burden, not to mention the costs of re-taking courses at a new institution.

In October 2020, we published a report that used data from IPEDS and NACUBO’s Student Financial Services Benchmarking Study to estimate, nationally, the number of students affected by this issue and the aggregate amount these students owe. Our report also provided an overview of programs that are attempting to address this problem at the state and local levels. While our initial report focused on the national landscape of stranded credits, understanding the issue at the state and regional level is essential to developing and scaling effective policy solutions. This is especially true now that state policymakers are increasingly examining their role in addressing concerns about transcript withholding after the passage of AB1313 in California in 2019, which banned the practice.

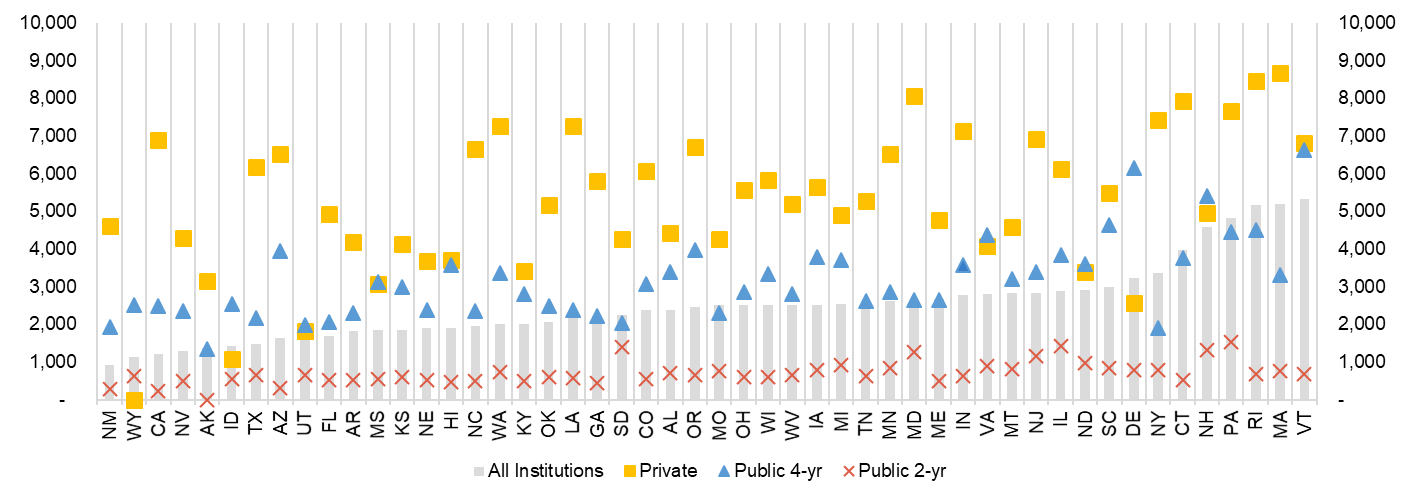

Because states’ contexts vary so widely, addressing the issue of “stranded credits” likely requires solutions tailored to those contexts. For instance, states with larger amounts of outstanding dollars but fewer students affected require different solutions than those with smaller average student debts. Research has indicated that the scope of the problem also differs across sector—students who attended community colleges make up a significant proportion of those impacted, but they often carry smaller debts than those who attended a private nonprofit institution (as can be seen in Figure 4 below).[1]

In this blog, we disaggregate the national statistics in our report to provide a detailed snapshot of the number of students affected and the size of their outstanding debt by state and sector. To understand how the evolving state policy landscape may affect these estimates in the future, we also provide an overview of new state policies that address the issue of stranded credits and transcript holds.

State and Sector Data on the Number of Students Affected and the Size of their Debt

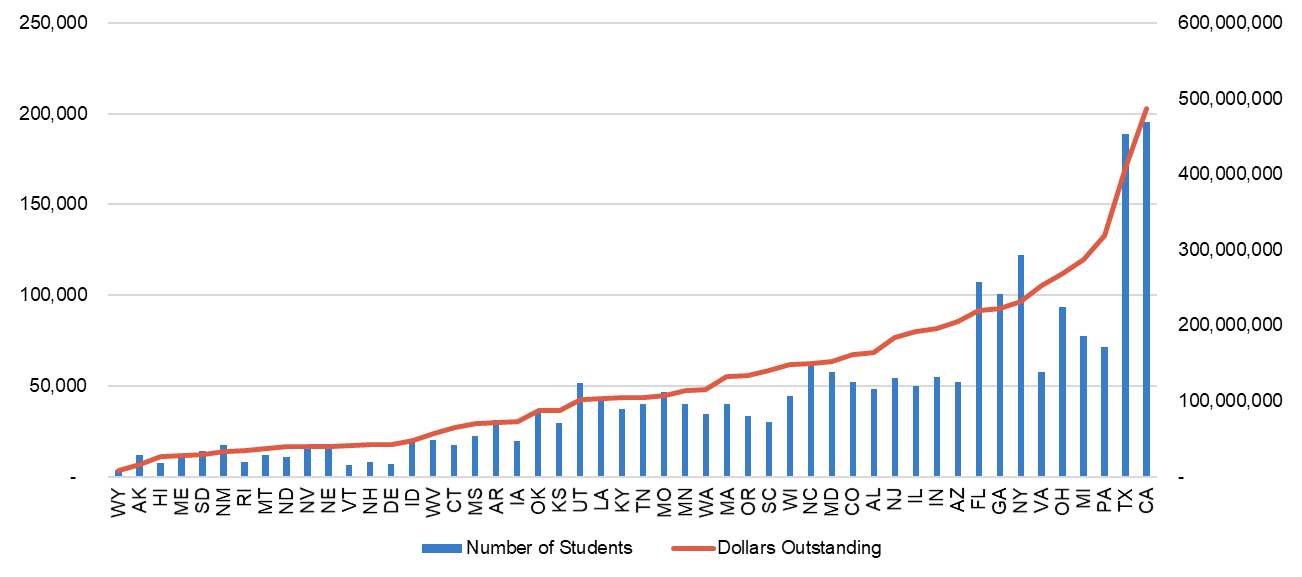

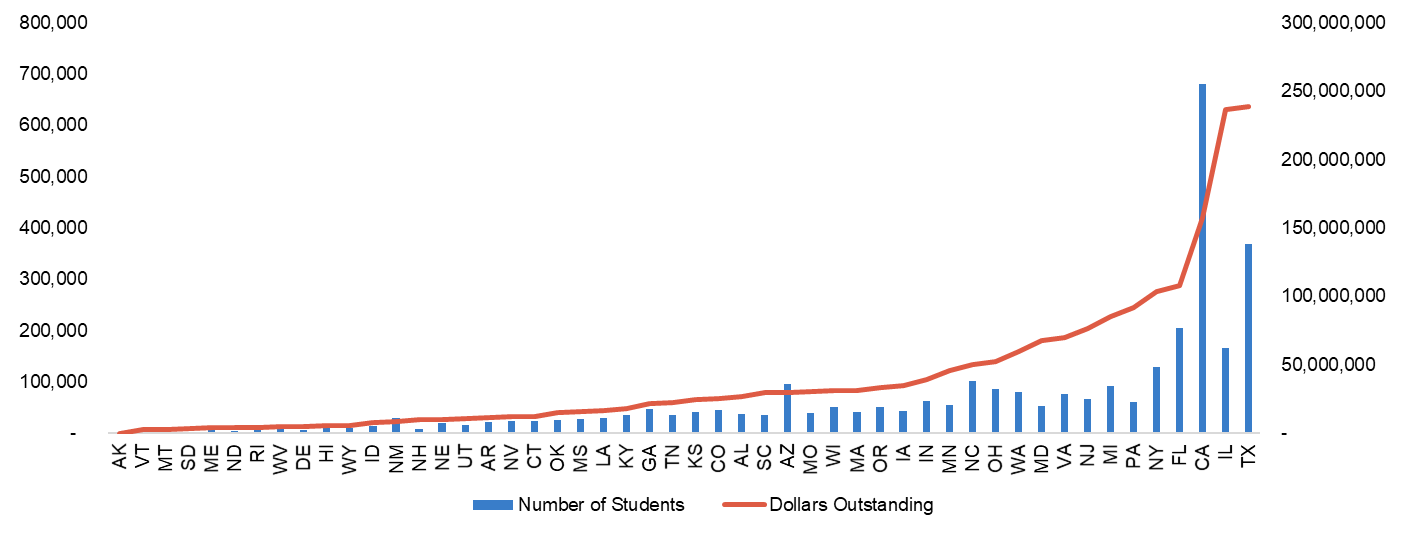

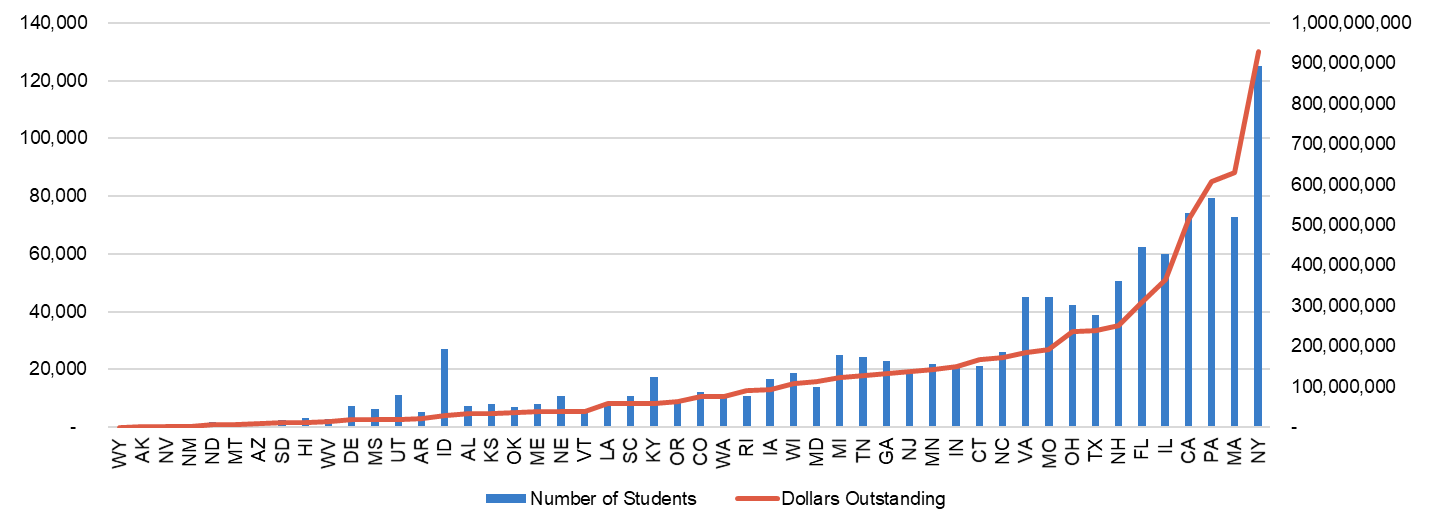

Figures 1 through 3 present the number of students affected and the total dollars outstanding to public four-year, public two-year, and private nonprofit institutions, respectively. Not surprisingly, states with the largest enrollments across all higher education sectors also have the most students affected and highest amounts of total debt owed. For example, California and Texas both have robust public higher education systems, and thus the estimated number of students with unpaid balances at public four- (Figure 1) and two-year (Figure 2) is expectedly high.

Figure 1: Number of students and total outstanding balances at public four-year institutions, by state

States with the largest estimated amount of unpaid debt are not necessarily those with the largest number of students estimated to hold this debt, in part, due to the variation in tuition prices and mix of in- and out-of-state students across campuses. Looking at public two-year colleges in Figure 2, we see Illinois and Pennsylvania have fairly high estimated total outstanding balances compared to the number of students affected. These two states also have the highest in-state tuition at community colleges. California, however, has the lowest in-state tuition and thus the total debt does not track as closely with the number of impacted students we estimate.

Figure 2: Number of students and total outstanding balances at public two-year institutions, by state

In Figure 3 we see states in the Northeast, with large numbers of private institutions, estimated to have the largest amount of debt and number of impacted students. Although the population of California is nearly six times the population of Massachusetts, they have a similar number of students at private colleges estimated to have stranded credits.

Figure 3: Number of students and total outstanding balances at private nonprofit institutions, by state

Figure 4, which presents the average debt owed across all states and sectors, reveals some key differences between states with large amounts of absolute debt. States such as Texas and California have proportionately large numbers of students affected which makes their average debt per student quite small; states like Illinois and Pennsylvania, on the other hand, have equally large absolute debt totals but fewer students impacted, leading to much larger average debt amounts for students in those states. States with the highest average balances are primarily concentrated in the Northeast part of the United States, likely driven by the prevalence of private institutions which have higher average debt totals.

Figure 4: Average debt per student, by state and sector

This variation in the estimated average balance is important for considering solutions to this problem. For example, in states with relative low average balances and larger shares of impacted students attending community colleges, debt forgiveness programs may be a promising option. Tuition-dependent private colleges, especially those with high average balances, may be hesitant to engage in full debt forgiveness because of the foregone revenue. For these institutions, an alternative solution that benefits institutions and students is likely necessary. Some states have begun addressing the issue of stranded credits by using philanthropic funds and federal grants to pay off balances, however, this strategy is unlikely to be sustainable. Beyond these institution-level solutions, policymakers have initiated or considered bans on transcript withholding. Below, we discuss these state policy solutions and the importance of understanding variations in state contexts when addressing the issue of stranded credits.

State Policies Enacted and Under Consideration

While organizations in places like Detroit and Northeast Indiana have developed more localized solutions to this problem, state policymakers are increasingly examining their ability to reform or eliminate the practice of transcript withholding. After California and Washington implemented bans on transcript holds in 2020, legislators in New York and Massachusetts have re-introduced bills that would also ban the practice in their states. Other states have passed or are considering more moderate bans. Louisiana, for example, passed a bill allowing boards of public higher education to adopt policies banning transcript withholding. Minnesota is also considering a ban on transcript holds for debts less than $500 or if an employer requests the transcript from the institution. It remains to be seen how many of these proposed bills will pass and what the impact of Louisiana’s policy will be, but regardless policymakers and researchers should monitor these bills to examine the effect of bans on institutional policies and student success.

The intent of these statewide bans is to help hundreds of thousands of students regain access to their transcripts, allowing them to escape a debt cycle that often leaves the poorest and most vulnerable student populations without means of economic advancement. However, the implementation of these bills could unleash unintended consequences that harm the very students the bills are trying to help. Through conversations with experts in the field we have learned that schools in states with bans in place have responded by adjusting their practices, requiring payment in full up-front or automatically dropping students partway through the semester if they are unable to pay in full rather than allowing students to pay off balances in parts throughout the term. These practices could harm students who need to pay over time, students who are waiting on federal aid deposits, and students who are waiting for employers to pay for educational benefits. Colleges may also ban students with outstanding balances from taking finals, which would mean students would lose all the time, effort, and money (including federal aid) put into any given course.

To effectively address the issue of stranded credits, policymakers need to understand the impact of the localized solutions and the statewide bans on both student outcomes and institutional finances. We need to understand the extent to which the described unintended consequences are occurring, and monitor other potential strategies colleges may take to recoup much-needed funds. The contexts in which these policies are implemented is also important for considering the effects on students. For example, states with a robust private higher education sector are likely to face different challenges than those where the problem of stranded credits is more highly concentrated at community colleges and impacted students have lower average balances.

Finally, the research community should monitor movement at the federal level and any potential legislation tied to transcript holds needs to be evaluated carefully. Examining the impacts of these policies will be important when designing future interventions that leave both students and institutions better off, and, most importantly, do not create any unintended adverse impacts on students primarily affected by stranded credits. Over the coming years, Ithaka S+R expects to develop and evaluate solutions tailored to the variation we see across states and sectors.

- The methodology behind our estimates is included in our October 2020 report. In this post, we aggregate the institution-level estimates to the sector-by-state level. As described in our initial report, we expect these estimates to be conservative as they are limited by data collection timelines and our analysis indicated the problem is growing over time. The underlying data can be accessed in this Excel sheet (download). ↑